Why a Professional Vendor Billing Invoice Matters

If you’re managing accounts payable, you’ve likely faced the burden of inaccurate or incomplete vendor invoices resulting in processing delays, compliance risks, and cash flow bottlenecks. One of the key tools for ensuring smooth and timely payments is receiving a clear, professional billing and invoice document from vendors.

When your AP team works with standardized, well-organized invoices, it becomes easier to validate charges, match them with purchase orders (POs), and process payments without unnecessary back-and-forth. Moreover, consistent invoice documentation supports Vendor Invoice Processing, compliance, audit readiness, and vendor trust. A clean and transparent billing and invoice workflow lays the foundation for efficient finance operations.

What Is a Vendor Billing Invoice

A vendor billing invoice is a formal request for payment sent by a supplier to your organization, usually in exchange for services rendered or goods delivered. In accounts payable, this document is the starting point of the invoice processing lifecycle.

Unlike customer invoices issued by your business, a vendor billing invoice is incoming. It must be verified for accuracy, matched to the corresponding purchase order (PO) and receipt (for 2-way or 3-way matching), and approved before payment.

With platforms like Serina.ai, AP teams can automate the intake, classification, validation, and approval of these invoices—reducing manual workload and avoiding costly errors.

Key Components to Expect in a Vendor Billing Invoice

To enable faster and accurate AP processing, ensure the invoices you receive from vendors include the following components:

- Unique Invoice Number

Helps prevent duplicate payments and simplifies tracking

- Vendor and Buyer Information

Includes the supplier’s legal name, contact details, tax ID, and your organization’s information

- Invoice Date and Due Date

Clearly states the issue and expected payment date—essential for managing cash flow and avoiding late fees.

- Itemized Description of Goods/Services

Lists each product or service delivered, including quantity, unit cost, and total.

- Subtotal, Taxes, and Total Amount

Breaks down pre-tax, tax, and grand total values, which is crucial for financial reporting and compliance.

- Payment Terms and Bank Details

Specifies payment method (bank transfer, ACH, etc.), payment terms (e.g., Net 30), and the account to which payment should be sent.

- Notes or Reference Fields

May include purchase order (PO) number, contract reference, or internal billing codes to facilitate matching.

- Tax Registration Details

Required for tax audits, especially if VAT or GST is applicable.

Serina.ai reads all these fields automatically using intelligent OCR and AI-powered validation. It matches them against POs, flags missing or mismatched information, and routes invoices for approval—all without manual data entry.

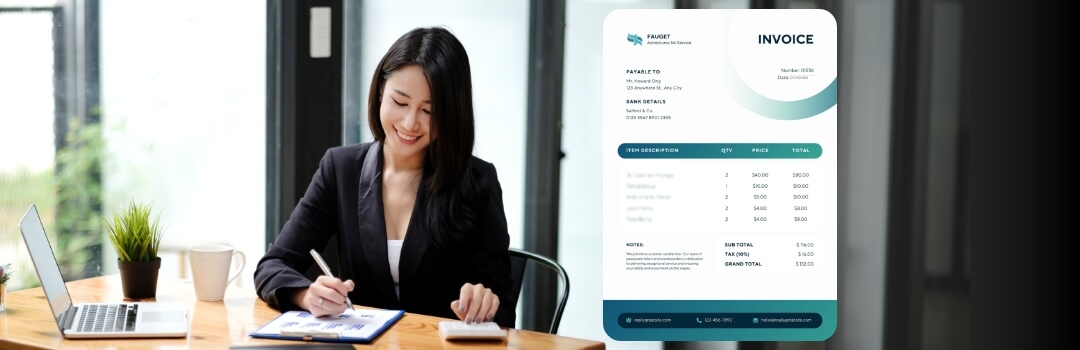

Sample Professional Billing Invoice Template

Above is a sample professional billing invoice that showcases the basic structure and details that should be included in your invoices:

The invoice includes an invoice number, and the date is clearly stated. The Payable to section includes the client’s name, address, and bank details for payment. The Item Description section breaks down the services provided, including various services with quantity and price listed for each. The subtotal is calculated, followed by the applicable tax and the grand total.

The invoice also includes a note thanking the client for their business and offering assistance if needed, and it concludes with relevant legal/tax information, such as tax registration numbers.

When vendors follow this structure, your AP process becomes faster, cleaner, and easier to automate using platforms like Serina.ai.

Why Accurate Vendor Invoices Are Critical for AP

Trust and Vendor Confidence

Well-structured invoices from vendors reduce queries and disputes and build operational trust. They also help avoid payment delays that could strain supplier relationships.

Faster Invoice Processing

Invoices with all required fields can be auto-processed. When paired with platforms like Serina.ai, the AP cycle can be reduced from days to minutes through intelligent matching and approval routing.

Easier Auditing and Reporting

A consistent invoice format across vendors helps simplify reconciliations, ensure tax compliance, and prepare for audits with minimal disruption.

Design and Submission Tips for Vendor Invoices

Standardized Format

Encourage vendors to use a consistent, approved invoice template. This reduces confusion and speeds up internal processing.

Clear Reference to PO or Contract

Always ask vendors to include a purchase order (PO) number or reference ID to enable auto-matching and avoid rejections.

Digital-First Submission

Move away from paper invoices. With Serina.ai, your AP team can automatically capture invoices from PDFs, emails, and portals—no printing or scanning required.

Common Vendor Invoicing Mistakes to Watch For

Even reputable vendors can send invoices with errors. Here are red flags AP teams should monitor:

- Missing Due Dates

- Incomplete or vague item descriptions

- Omitted tax information or payment terms

- Missing PO number or business contact

- Duplicate invoice numbers across billing cycles

Serina.ai automatically detects and alerts users to these issues, helping AP teams resolve them before they reach the approval stage.

Frequently Asked Questions

How do I verify a billing invoice from a vendor?

Check for PO number, item descriptions, and pricing accuracy. Use automated tools like Serina.ai to streamline validation and reduce manual checks.

Can I process an invoice without a PO?

Yes, but it increases risk. Serina.ai supports non-PO invoices but recommends clearly documented approval paths for compliance.

How can I avoid late payments to vendors?

Ensure invoices are processed as soon as they’re received. Tools like Serina.ai accelerate this by automating invoice intake, approval, and ERP sync.

Should I require taxes on all vendor invoices?

If your jurisdiction or procurement type mandates GST/VAT, ensure vendors include accurate tax details. Serina.ai can validate these fields automatically.

Start Processing Vendor Invoices Smarter

Vendor invoices are more than just payment requests—they’re critical inputs into your AP, compliance, and cash flow strategy. Ensuring they’re accurate and standardized makes every part of finance smoother.

If your team is spending too much time chasing down missing data, routing approvals, or correcting invoice errors—it’s time to automate.

Talk to our experts and see how Serina.ai can transform your invoice intake, approval, and payment processes end-to-end.